Insurance software

that is

Technology that makes business sense.

Welcome to

Aladdin Software.

Aladdin is a leading enterprise software solution for insurance companies and underwriting managers. It offers process automation, agility, new sales channels and comprehensive business intelligence to grow profitability.

Increased sales

Grow premium income by empowering every channel—from brokers to direct partners—with fast product launches and intuitive, guided selling experiences.

- Launch in days

- Agent self-service

- Guided quoting

- Unified channel API

- Cloud-enabled reach

- Rapid innovation

Process automation

Aladdin automates underwriting, billing, claims and compliance tasks with configurable rules and communications that keep every transaction consistent and controlled.

- Automated risk checks

- Premium adjustments

- Fast-tracked claims

- Automated communications

- Payments & credit

- Self-service relief

Improved intelligence

Respond to market and regulatory change with a configurable platform that links financial, workflow and underwriting data for fast, data-driven decisions.

- Profitability tracking

- Integrated data

- Multi-regime accounting

- Data-driven pricing

- Governed reporting

The safe choice

Built to deliver quickly—and reliably

Proven reliability

Production-tested for more than a decade at leading insurers, administrators and global online distributors.

Rapid implementation

Designed for fast setup, policy migration and integration with existing systems so you can launch in weeks.

Flexible cost models

Competitively priced with commercial options tailored to your product mix and growth plans.

“Any sufficiently advanced technology is indistinguishable from magic.”

- Arthur C. Clarke

Our solution

Components

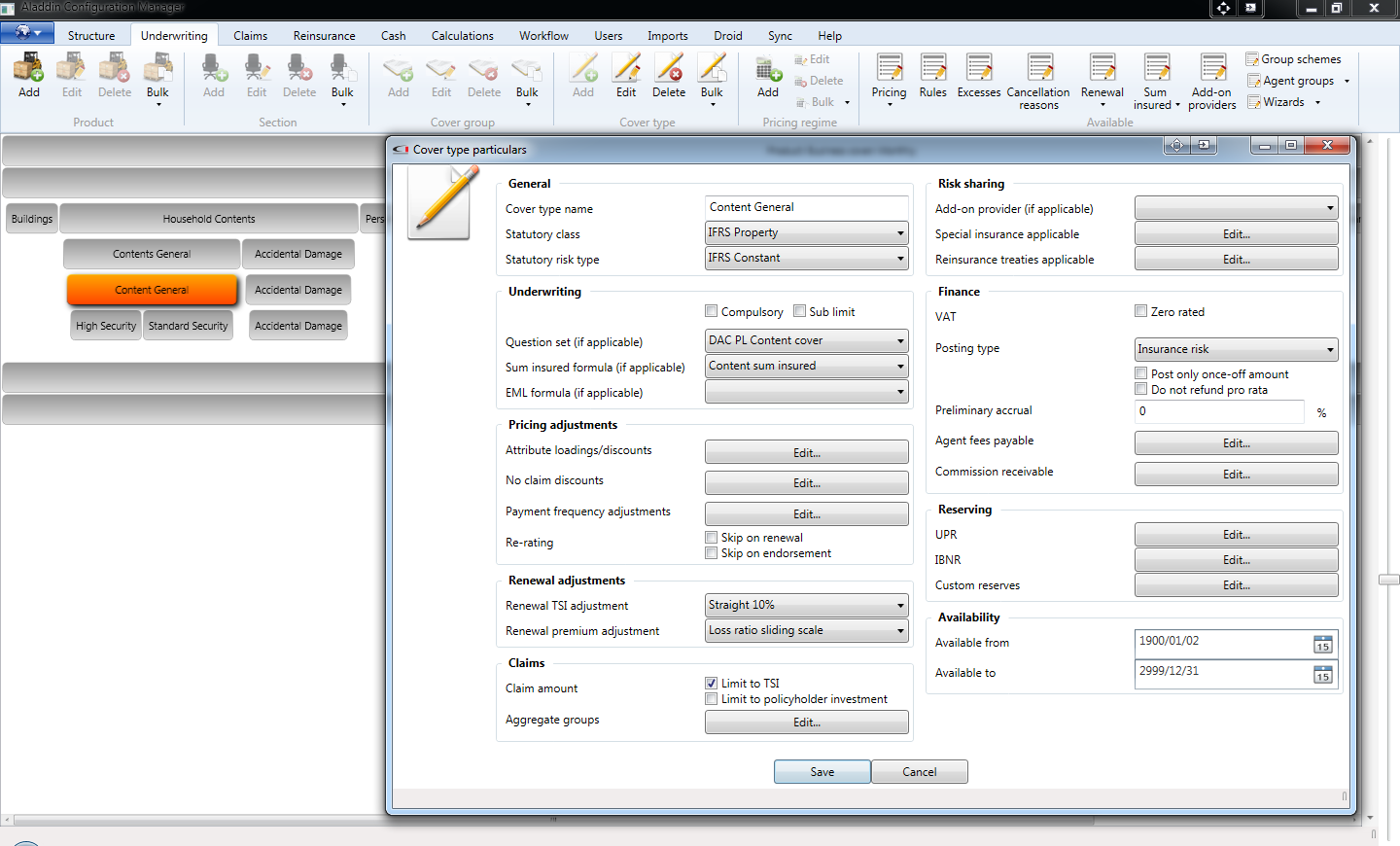

Config manager

The Configuration Manager allows business users to rapidly launch new products and intelligent workflow with zero coding required.

-

Configure products, pricing and workflow with zero code

-

Build modular components that drive the Aladdin UI and Wizard

-

Centralise business rules for underwriting, pricing and communications

-

Automate settlements, debit retries and cancellations through configurable logic

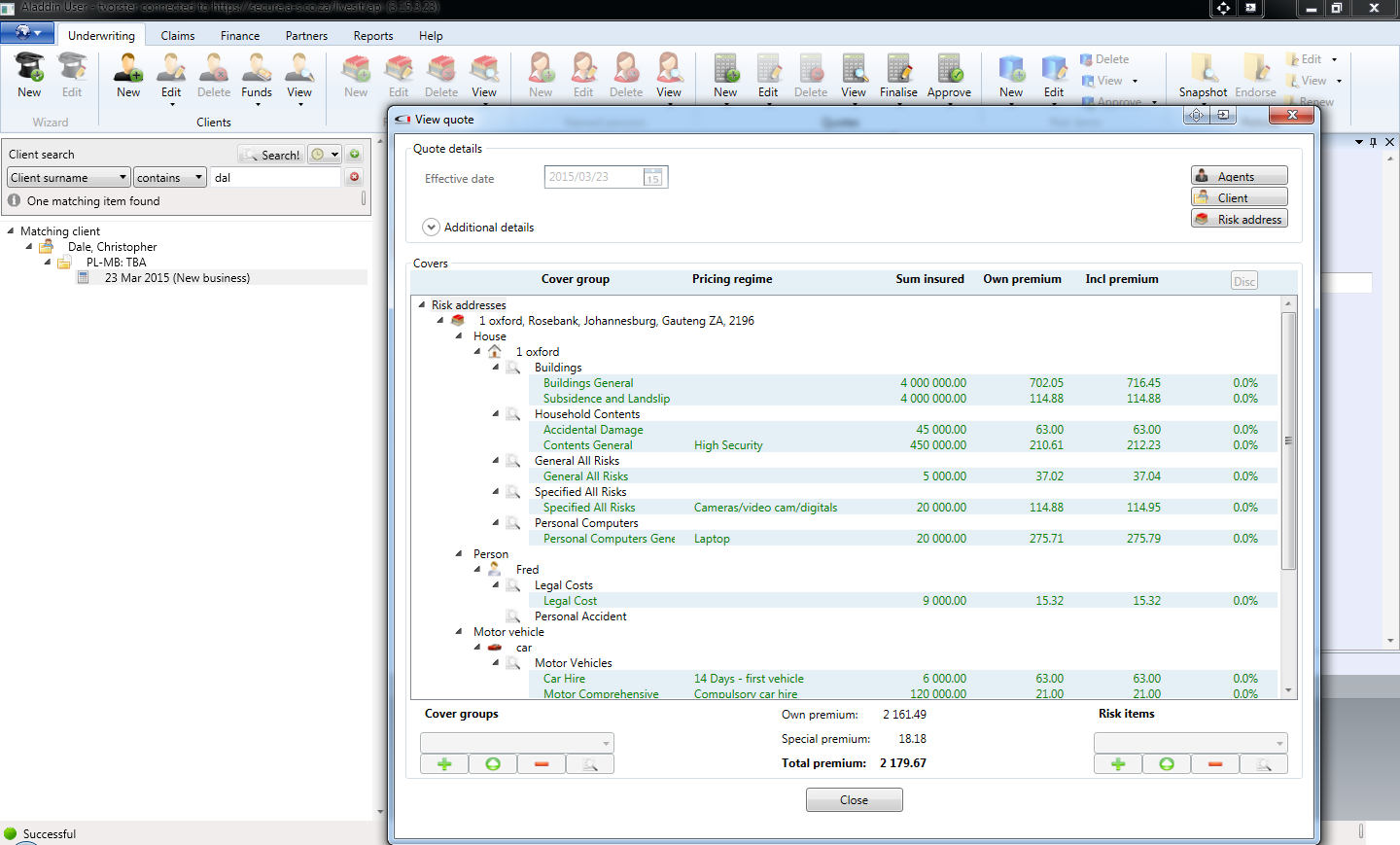

Windows app

The user friendly front-end application is used by staff to manage sales, underwriting, claims, finance, compliance and reporting.

-

Role-based permissions to focus each user on underwriting, claims or finance tasks

-

Guided tabs and ribbons streamline quoting, activation and endorsements

-

Built-in claims, recoveries and service provider management workflows

-

Finance and reporting views for settlements, debit runs and compliance oversight

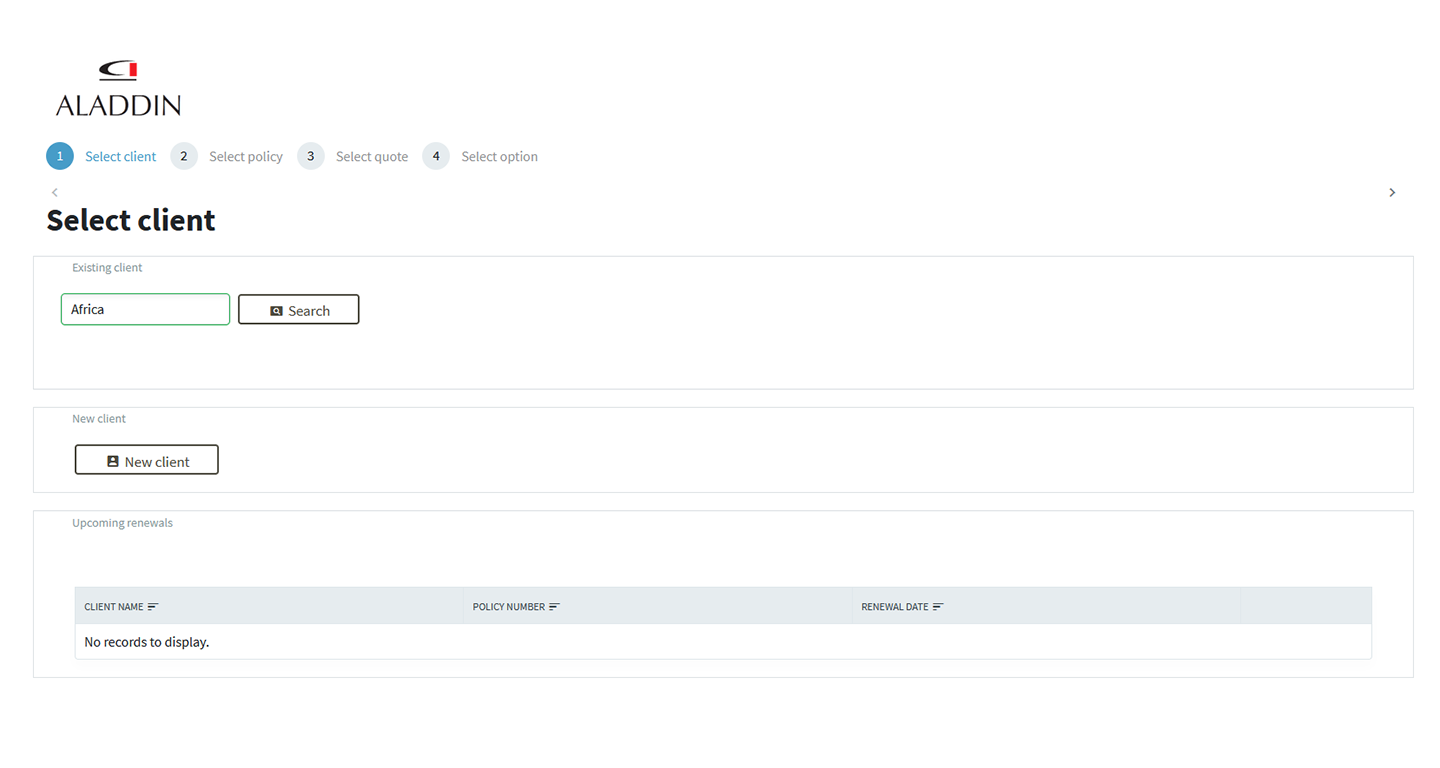

Broker portal

The broker self-service portal allows agents to write new business, process endorsements and renewals and draw statements and other reports.

-

Quote and bind new business through broker-friendly workflows

-

Submit endorsements and renewals with automatic validations

-

Access statements, commission insights and other reports on demand

-

Maintain client and policy data securely without back-office delays

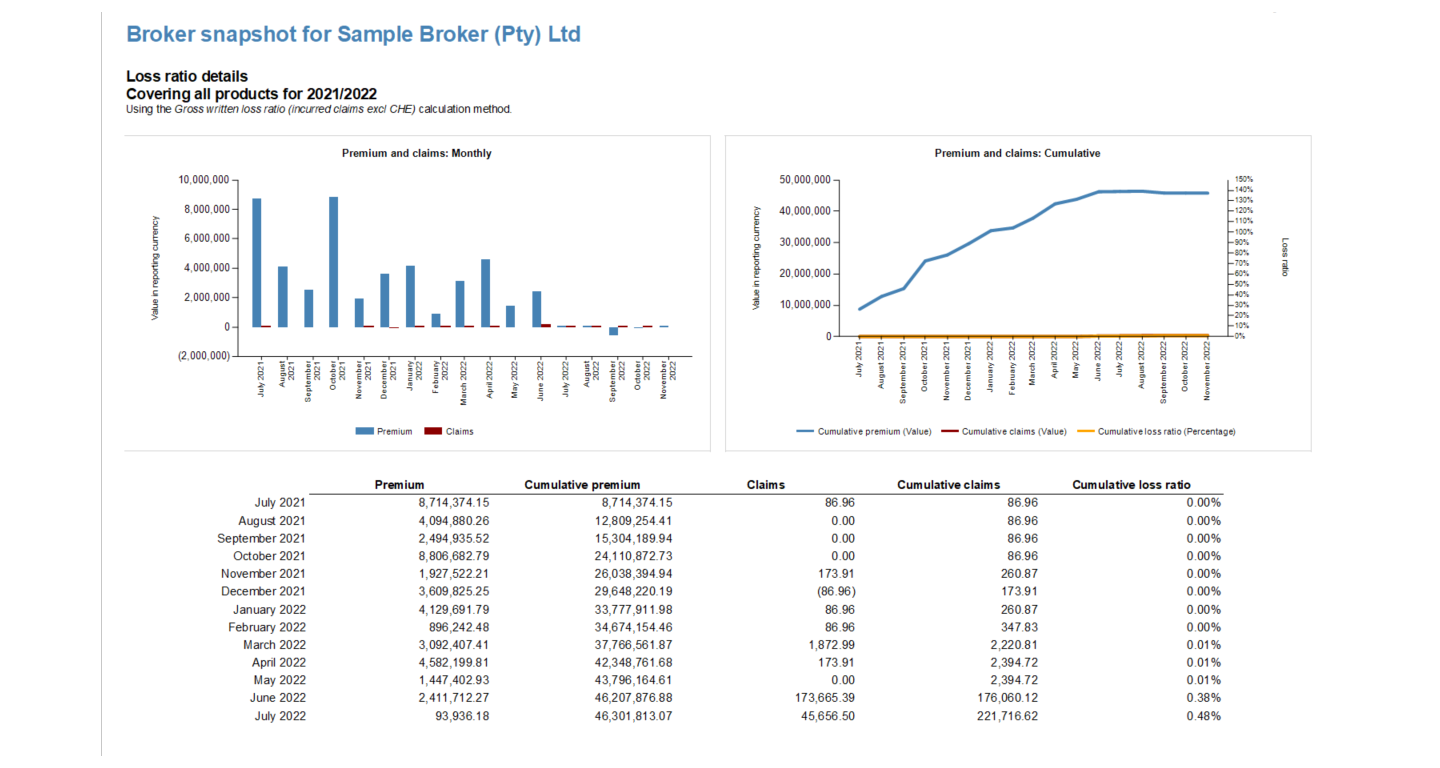

Business intelligence

The BI and Reporting module facilitates comprehensive, accurate and consistent reporting and meaningful business intelligence.

-

Build SQL-backed reports with live data direct from the core database

-

Schedule automated report delivery for stakeholders

-

Create custom views for profitability, loss ratios and sales KPIs

-

Ensure consistent, accurate insights with SSRS governance

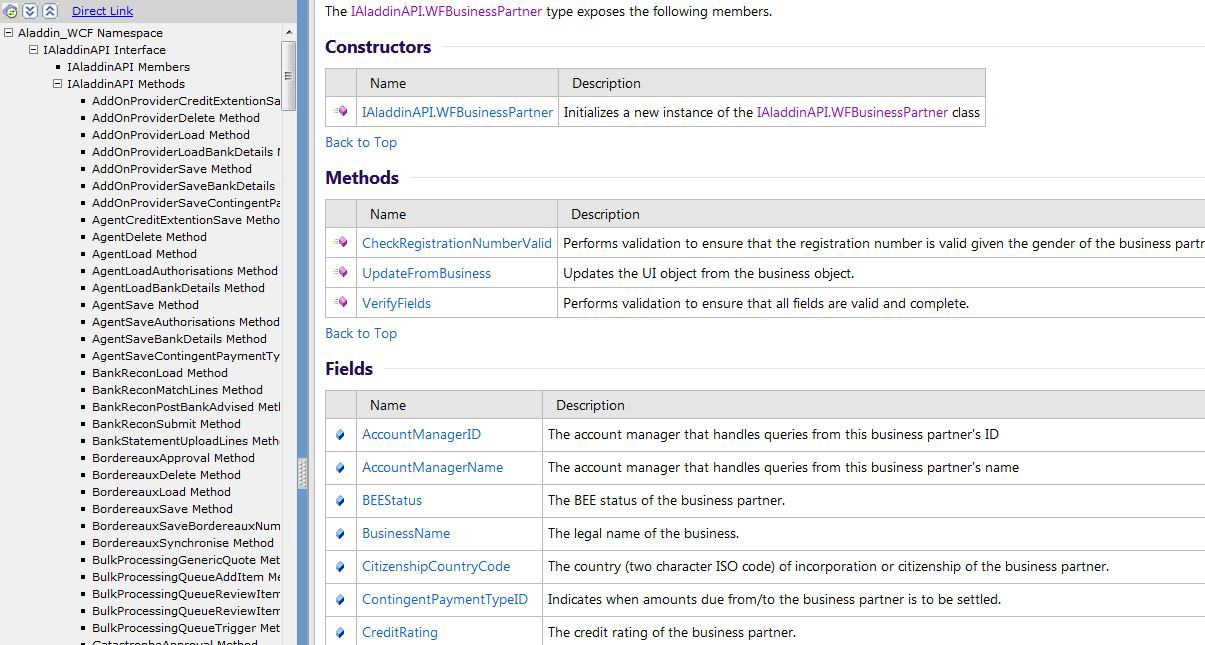

Core API

The core web service (API) is a scalable platform that validates and processes all transactions and facilitates third party system integration.

-

Centralised validation and authentication for every transaction

-

Single service layer for Windows app, portals and third-party integrations

-

Enforces consistent business rules across all channels

-

Scalable architecture simplifies legacy and partner integrations

Selected features

Custom products and workflow

Aladdin boasts a configuration tool where the setup of products, workflow processes, underwriting and business rules, workflow rules, access permission groups and collection methods can be done by business users.

Custom questions on all screens

Client, underwriting, claims and supplier screens make provision for custom questions to be asked. The question can either have free text or multiple choice answers.

Quote wizard

Aladdin features a quote wizard which enables partners in the sales channel (e.g. brokers) to log in and do their own quotes. It has a step-by-step process to add items to a quotation and can provide comparative quotes.

Cloud architecture

The Aladdin front-end makes use of a web-service which is accessible over the internet and therefore allows for users to connect from anywhere in the world, as long as they have an internet connection.

Intelligent workflow and automated communication

Aladdin has the ability to make intelligent decisions based on business rules provided at any stage in the workflow process, including automated vendor notifications and quote requests.

End-to-end insurance process management

Aladdin manages the end-to-end insurance process, including underwriting, claims, cash, accounting, workflow and reserving with cover-specific rules and controls.

Profitability and exposure data at lowest level

Aladdin provides a full income statement up to underwriting profit and related balance sheet on a cover, policy, agent and postal code and level. Profitability can therefore be tracked in the finest detail.

Strong accounting and cash management

Aladdin features a leading accounting module, which manages cash flows exceptionally well. Accounting is also done on an IFRS and statutory basis, saving time to convert IFRS accounts to statutory accounts.

Automated underwriting & renewals

Automate acceptance, loadings and renewals with cover-level rules, including automatic sum insured and premium adjustments based on risk or loss experience.

Integrations and portals

Provide 24/7 access for clients or intermediaries via custom apps or websites, backed by turn-key payment, collection, credit score and valuation integrations.

In our clients' words

Interested?

Contact us

Let's explore how we can leverage our technology to reach your business goals.

Support

Existing customers receive priority support through Sifter, our issue tracking portal.

Technical support